sales tax calculator austin texas

VesselBoat Application PWD 143 Outboard Motor Application PWD 144. The average cumulative sales tax rate between all of them is 708.

County Surcharge On General Excise And Use Tax Department Of Taxation

The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value.

. The combined rate used in this calculator 825 is the result of. Austin County TX Sales Tax Rate. Ad See how to streamline your sales tax filings and improve accuracy before annual reporting.

2022 Cost of Living Calculator for Taxes. Use this calculator with the following forms. The Sales Tax Calculator can compute any one of the following given inputs for the remaining two.

The Austin County sales tax rate is. Reduce complexity by outsourcing the preparation and filing of sales tax returns to Sovos. Sales tax in Austin Texas is currently 825.

And all states differ in their. You can print a 825 sales tax table here. Reduce complexity by outsourcing the preparation and filing of sales tax returns to Sovos.

Sales Tax Rate s c l sr. Enter zip codeof the sale location or the sales tax ratein percent Sales Tax Calculate By Tax Rateor calculate by zip code ZIP Code Calculate By ZIP Codeor manually enter sales tax Texas. You can calculate Sales Tax manually using the formula or use the Austin Sales Tax Calculator or compare Sales Tax between different locations within Texas.

Cost of Living Indexes. The December 2020 total local sales tax rate was also 6750. 625 percent of sales price minus any trade-in allowance.

Austin TX Sales Tax Rate The current total local sales tax rate in Austin TX is 8250. The sales tax rate for Austin was updated for the 2020 tax year this is the current sales tax rate we are using in the Austin Texas Sales Tax. The Texas sales tax rate is currently.

The 2018 United States Supreme Court decision in South Dakota v. Free sales tax calculator tool to estimate total amounts. Has impacted many state nexus laws and sales tax collection.

Austin Texas and Bonita Springs Florida. Taxable sales 15000 x tax rate 825 percent sales tax amount 1238 You are able. The 825 sales tax rate in Austin consists of 625 Texas state sales tax 1 Austin tax and 1 Special tax.

As far as other cities towns and locations go the place with. The most populous location in Austin County Texas is Sealy. There is no applicable county tax.

This is the total of state county and city sales tax rates. The base sales tax in Texas is 625. United States Tax ID Number Business License Online Application.

Florida are 210 cheaper than Austin Texas. How to use Austin Sales Tax Calculator. See reviews photos directions phone numbers and more for Sales Tax Calculators locations in Austin TX.

BoatMotor Sales Use and New Resident Tax Calculator. The Austin Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 Austin local sales taxesThe local sales tax consists of a 100 city sales tax and a 100 special. You can also use Sales Tax calculator at the front page where you can fill in percentages by yourself.

US Sales Tax calculator Texas Austin. Check your city tax rate from. Ad See how to streamline your sales tax filings and improve accuracy before annual reporting.

The County sales tax rate is. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Enter your Amount in the respected text field Choose the Sales Tax Rate from the drop-down list.

Before-tax price sale tax rate and final or after-tax price. The December 2020 total local sales tax rate was also 8250. For additional information see our Call Tips and Peak Schedule webpage.

The minimum combined 2022 sales tax rate for Austin Texas is. Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as. The current total local sales tax rate in Austin County TX is 6750.

Austin TX Sales Tax Rate. Texas Sales Tax. While Texas statewide sales tax rate is a relatively modest 625 total sales taxes including county and city taxes of up to 825 are levied.

Sales Taxes In The United States Wikiwand

H R Block Tax Calculator Services

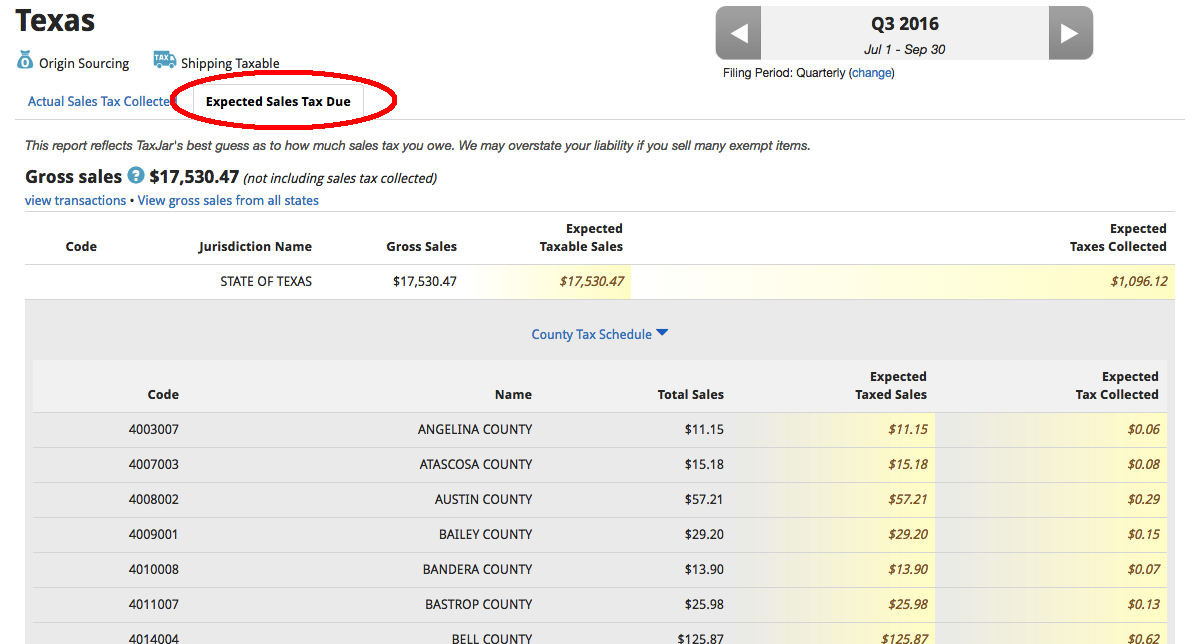

Texas Sales Tax Guide And Calculator 2022 Taxjar

Texas Sales Tax Small Business Guide Truic

Some Texas Online Sellers Receive Alarming Sales Tax Penalty Notification Taxjar

Managing Your Cash Flow To Stay In Business Long Term Scoresmallbiz Https Greatercincinnati Score Org Event Managing You Investing Filing Taxes Tax Attorney

Fix Your Instagram Feed On Squarespace Squarespace Web Design By Christy Price Squarespace Web Design Squarespace Instagram Feed

Capital Gains Tax Calculator 2022 Casaplorer

Texas Income Tax Calculator Smartasset

How To Find Original Price Tax 1 Youtube

How To Charge Sales Tax Vat With Samcart Samcart

Automatically Calculate Sales Tax In Squarespace Squarespace Web Design By Christy Price Squarespace Squarespace Web Design Web Design

How To Calculate Texas Sales Tax

Why Does Walmart Com Charge 10 Sales Tax In Texas When It Should Be 8 25 Quora

Sales Taxes In The United States Wikiwand

H R Block Tax Calculator Services

State Corporate Income Tax Rates And Brackets Tax Foundation

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity