san fran sales tax rate

Online videos and Live Webinars are available in lieu of in-person classes. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

California Sales Tax Rates By City County 2022

The latest sales tax rate for San Francisco CA.

. SAN FRANCISCO COUNTY 8625 SAN JOAQUIN COUNTY 775 City of Lathrop 875. If an operator receives 40000 or less per year in parking revenue. Some businesses are also required to file and pay the Gross Receipts Tax and other annual taxes.

Parking Operators file and pay taxes monthly and have additional requirements including a Certificate of Authority a Parking Bond and Revenue Control Equipment fees. This includes the rates on the state county city and special levels. San Francisco has parts of it located within San Mateo County.

This county tax rate applies to areas that are not within the boundaries of any incorporated cities within the Del Norte county. The Sales and Use tax is rising across California including in San Francisco County. The December 2020 total local sales tax rate was 8500.

The San Francisco County California sales tax is 850 consisting of 600 California state sales tax and 250 San Francisco County local sales taxesThe local sales tax consists of a 025 county sales tax and a 225 special district sales tax used to fund transportation districts local attractions etc. Please contact the local office nearest you. Did South Dakota v.

The San Francisco Business Portal is the ultimate resource for starting running and growing a business in our City. What is the sales tax rate in San Francisco California. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

The San Francisco County Sales Tax is collected by the merchant on all. The State of California doesnt just collect sales tax. The average sales tax rate in California is 8551.

In San Francisco the tax rate will rise from 85 to 8625. The South San Francisco California sales tax is 750 the same as the California state sales taxWhile many other states allow counties and other localities to collect a local option sales tax California does not permit local sales taxes to be collected. Ad Find Out Sales Tax Rates For Free.

Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021. California has a 6 sales tax and San Francisco County collects an additional 025 so the minimum sales tax rate in San Francisco County is 625 not including any city or special district taxes. Method to calculate San Francisco sales tax in 2021.

Click on a tax below to learn more and to file a return. There is no applicable city tax. 4 rows San Francisco CA Sales Tax Rate The current total local sales tax rate in San Francisco.

The County sales tax rate is. The California sales tax rate is currently 6. The San Francisco County sales tax rate is 025.

The latest sales tax rate for South San Francisco CA. The minimum combined 2022 sales tax rate for San Francisco County California is 863. The County sales tax rate is 025.

San Francisco County in California has a tax rate of 85 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in San Francisco County totaling 1. City Total Sales Tax Rate San Francisco 8500 San Jose 9250 Santa Ana 9250 Santa Clarita 9500 What state has lowest sales tax. Businesses impacted by the pandemic please visit our.

It also has a franchise tax corporate income tax and alternative minimum tax. This rate includes any state county city and local sales taxes. The sales tax jurisdiction name is San Francisco Tourism Improvement District which may refer to a local government division.

How much is sales tax in San Francisco. The total sales tax rate in any given location can be broken down into state county city and special district rates. The 2018 United States Supreme Court decision in South Dakota v.

This is the total of state county and city sales tax rates. Rounding out the top 15 states with the lowest sales tax ratesall under 5 percentare Colorado at 29 percent and Alabama Georgia Hawaii New York and Wyoming all at 4 percent. Proposition F eliminates the Citys Payroll Expense Tax and gradually raises the.

This is the total of state and county sales tax rates. Within San Francisco there are around 39 zip codes with the most populous zip code being 94112. Most of these tax changes were approved by.

1788 rows CDTFA public counters are now open for scheduling of in-person video or phone appointments. The California state sales tax rate is currently 6. San Francisco Accra Ghana.

Method to calculate San Francisco County sales tax in 2021. The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375. The City currently imposes a 25 tax on total parking charges for all off-street parking throughout the City.

2020 rates included for use while preparing your income tax deduction. The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375 Special tax. The average sales tax rate in California is 8551.

The San Francisco sales tax rate is. The minimum combined sales tax rate for San Francisco California is 85. This is the total of state county and city sales tax rates.

2020 rates included for use while preparing your income tax deduction. This rate includes any state county city and local sales taxes. The minimum combined 2022 sales tax rate for San Francisco California is.

Which taxes apply to you and how you pay them depends on your business type. The average sales tax rate in California is 8551. For questions about filing extensions tax relief and more call.

Method to calculate San Francisco County sales tax in. Fast Easy Tax Solutions. The California sales tax rate is currently.

This is the total of state county and city sales tax rates. The San Francisco County California sales tax is 850 consisting of 600 California state sales tax and 250 San Francisco County local sales taxes. The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375.

The average cumulative sales tax rate in San Francisco California is 864. San Francisco County Sales Tax Rates for 2022. California Sales and Use Tax Rates by County and City Operative April 1 2022 includes state county local and district taxes.

The local sales tax consists of a 025 county sales tax and a 225 special district sales tax used to fund transportation districts local attractions etc. You can find more tax rates and allowances for San Francisco County and California in the 2022 California Tax Tables. The December 2019 total local sales tax rate was also 8500.

The December 2020 total local sales tax rate was 9750.

Understanding California S Sales Tax

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

Understanding California S Sales Tax

San Francisco Taxes Where Does The Money Go By Michael Sutyak Medium

No April Fools Joke City Sales Tax Rises To 10 25 April 1 El Cerrito Ca Patch

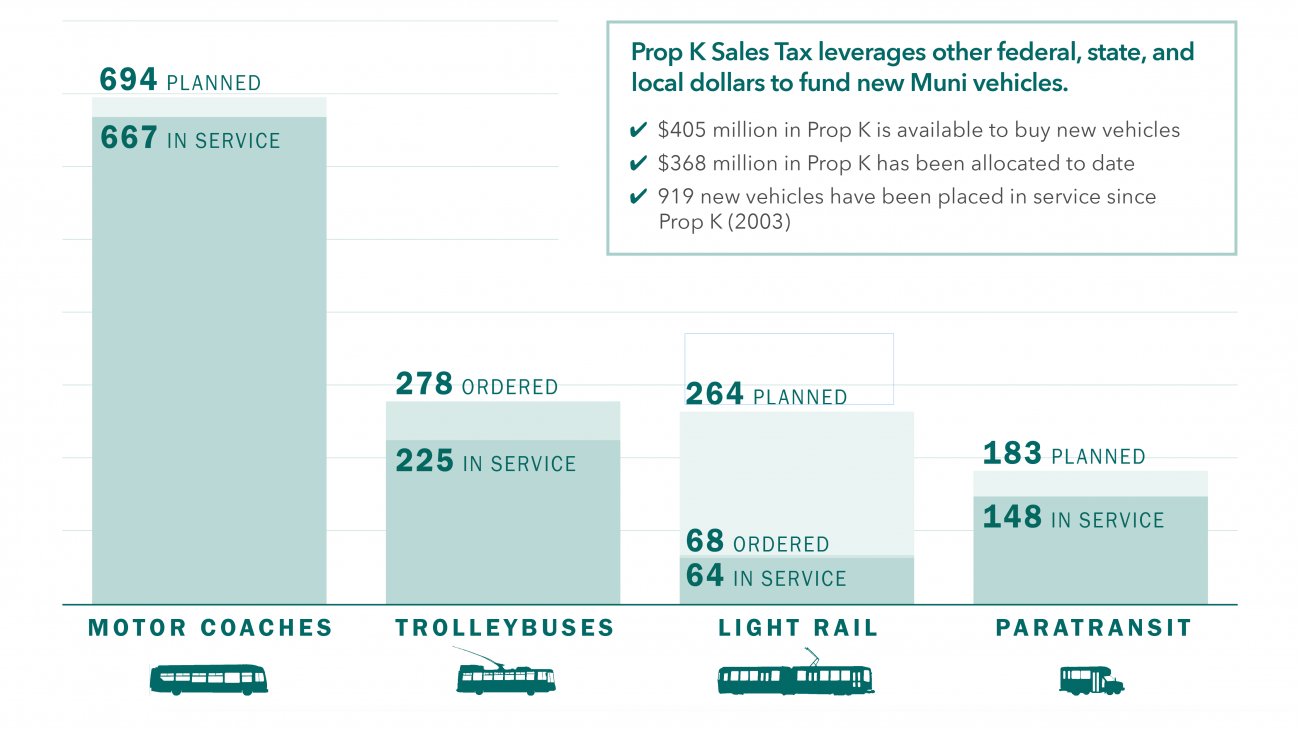

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

Sales Tax Collections City Performance Scorecards

Sales Associate Salary In San Francisco Ca Comparably

San Francisco Taxes Where Does The Money Go By Michael Sutyak Medium

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

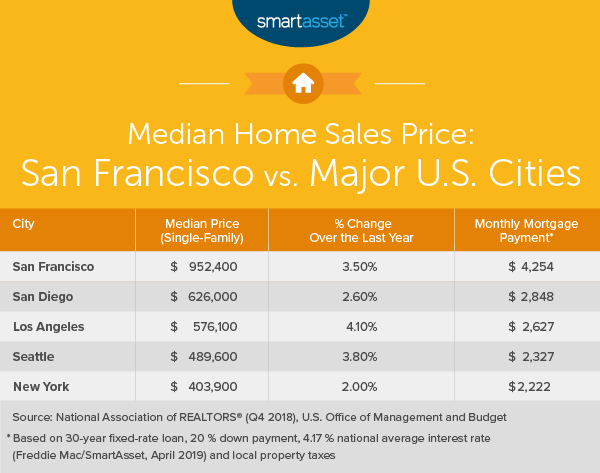

What Is The True Cost Of Living In San Francisco Smartasset

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

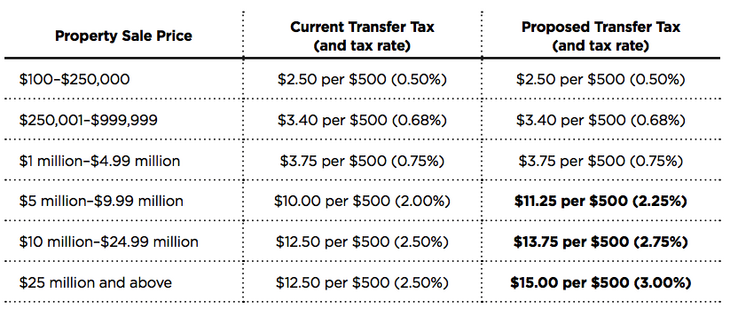

San Francisco Prop W Transfer Tax Spur

Sales Tax On Saas A Checklist State By State Guide For Startups

San Francisco Prop W Transfer Tax Spur

Secured Property Taxes Treasurer Tax Collector

The Bay Area Today Plan Bay Area 2040 Final Plan

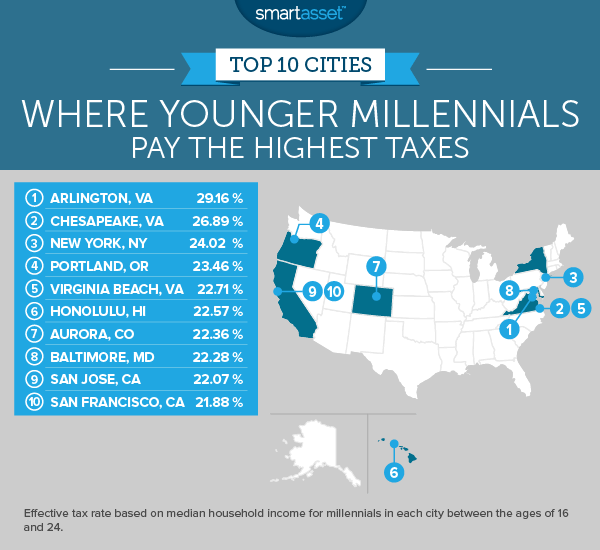

Where Millennials Pay The Highest Taxes 2017 Edition Smartasset